UX Strategy in Fintech Applications: The Power of User-Centered Design

- Introduction: A New Era in Financial Technology

- 1. User-Centricity: Putting People First

- 2. Balancing Security and Experience

- 3. Notifications: The Value of Proactive Communication

- 4. API Integrations: One-Stop Financial Hubs

- 5. Data Visualization: Making Numbers Meaningful

- 6. The Design Process: A Proven Path to Success

- 7. Microcopy: Small Words, Big Impact

- 8. User Flows: Designing Seamless Journeys

- 9. Colors and Visual Language

- 10. Device Adaptability and Performance

- 11. Best Practices for Fintech UX

- 12. Challenges in Fintech Design

- Conclusion: UX = Financial Success

Introduction: A New Era in Financial Technology

As of 2025, financial technology has moved far beyond digitizing banking processes. Today, fintech applications touch millions of lives, from payments and investments to digital wallets and personal finance management.

In such a competitive market, what sets a fintech app apart is not just the features it offers, but the experience it delivers. User experience (UX) is no longer a differentiator—it has become the single most critical driver of financial success.

So, how can you design an exceptional fintech application? Let’s break it down step by step.

1. User-Centricity: Putting People First

Every time a user opens a fintech app, they interact directly with their financial data. This naturally creates much higher expectations for trust compared to other digital products.

- Intuitiveness: Flows must simplify even the most complex financial processes.

- Accessibility: Cater to a diverse range of users with varying ages, backgrounds, and tech familiarity.

- Transparency: Clearly communicate every step of the journey to build confidence.

At VOYA, every fintech design project begins with defining personas, mapping expectations, and addressing potential pain points. Because trust begins with thoughtful design.

2. Balancing Security and Experience

Security is non-negotiable in fintech applications. Yet, overly complicated flows often frustrate users and lead to churn.

- Biometric authentication: Fingerprint and facial recognition enhance trust and speed.

- Multi-factor authentication: Adds an extra layer without overwhelming the user.

- Risk-based security: Apply stricter checks only when necessary—like new devices or unusual activity.

The golden rule: strengthen security without sacrificing simplicity.

3. Notifications: The Value of Proactive Communication

Fintech users want more than a place to complete transactions; they want control over their financial lives. Notifications make this possible.

- Real-time transaction alerts keep users informed.

- Security warnings ensure immediate action on suspicious activity.

- Payment reminders help users avoid missed deadlines or penalties.

When designed thoughtfully, notifications increase engagement and provide a sense of empowerment—especially when users can customize them.

4. API Integrations: One-Stop Financial Hubs

Modern fintech apps are ecosystems. With the right API integrations, users can manage multiple financial needs without switching platforms.

- Linking bank accounts

- Enabling payment gateways

- Connecting to investment or insurance platforms

This positions the app as a daily financial assistant, not just a utility.

5. Data Visualization: Making Numbers Meaningful

Financial data is often intimidating in raw form. Effective visualization transforms it into actionable insights.

- Spending patterns: Easy-to-read charts and categories

- Investment tracking: Clear performance indicators

- Personalized dashboards: Custom views aligned with user goals

In fintech, a dashboard should not just display information—it should empower decisions.

6. The Design Process: A Proven Path to Success

Designing a fintech app requires more than inspiration; it requires a structured approach.

1. UX Research: Identify user needs and pain points.

2. Business Planning: Define goals and positioning.

3. Wireframes & Prototypes: Test early, iterate often.

4. MVP & Launch: Go live quickly, then refine continuously.

5. Maintenance & Updates: Keep pace with evolving expectations and regulations.

At VOYA, our mantra is: learn from users, design, test, improve, repeat.

7. Microcopy: Small Words, Big Impact

The language of a fintech app directly shapes trust. Ambiguous or harsh copy can trigger anxiety, while clear and friendly wording reassures.

- Buttons: “Confirm Payment” is better than “Continue.”

- Error messages: Replace “Something went wrong” with “Your card details seem invalid—please check and try again.”

- Onboarding text: Welcoming, simple, and confidence-building.

In fintech, microcopy is as important as interface design.

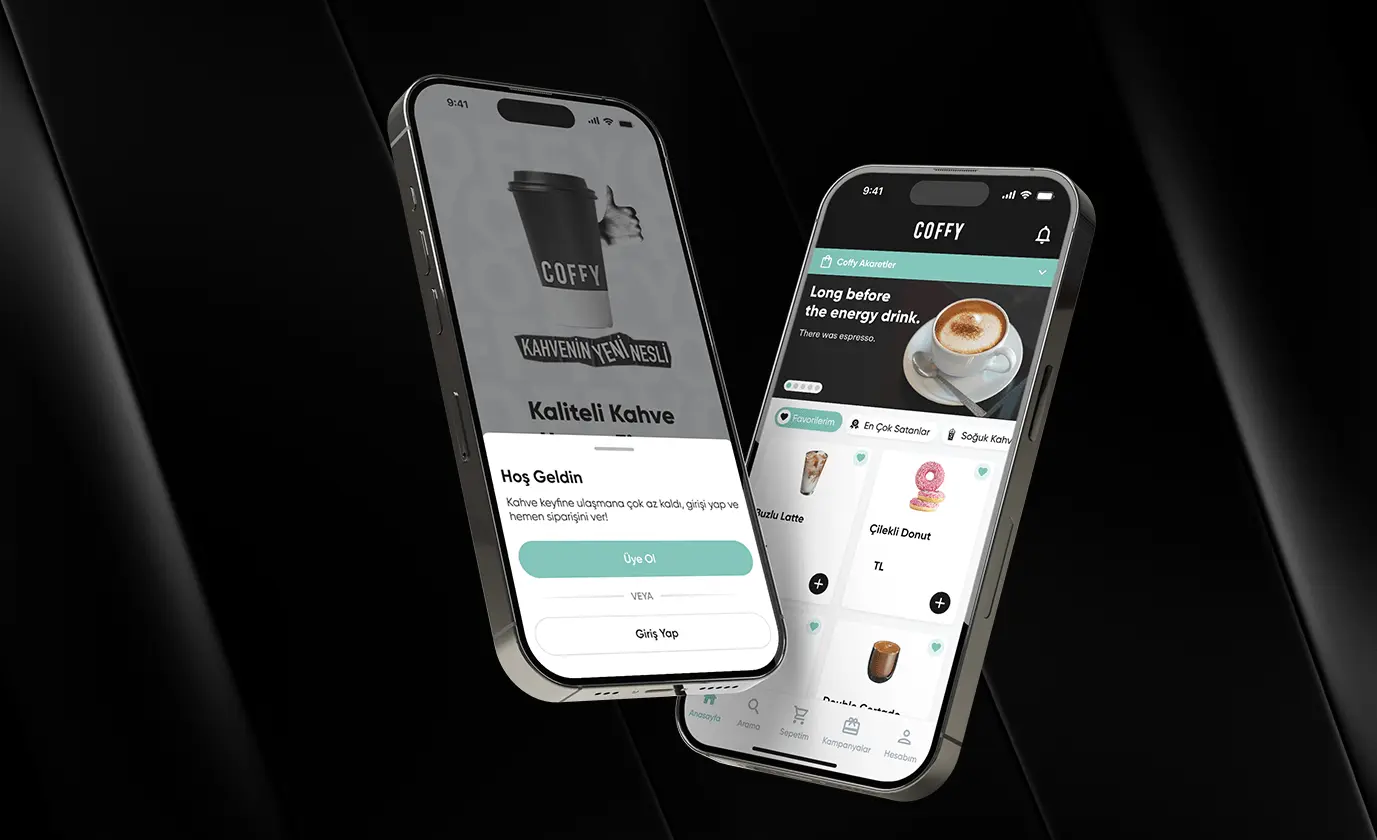

8. User Flows: Designing Seamless Journeys

From onboarding to transactions, user flows determine whether customers stay engaged—or leave frustrated.

- First-time users: Guided onboarding with clear steps.

- Returning users: Quick shortcuts to frequent tasks.

- Different personas: Tailored flows for investors, small businesses, or students.

A well-crafted flow should feel effortless, never overwhelming.

9. Colors and Visual Language

Colors shape trust and perception in financial services:

- Blue: Trust, stability, security

- Green: Growth, financial health

- Orange: Energy and innovation

- Red: Warning, caution

A consistent visual language strengthens both usability and brand identity.

10. Device Adaptability and Performance

Even the most beautiful design fails if the app is slow or unresponsive.

- Responsive design: Adapt to every screen size.

- Performance-first: Apps should load in under 3 seconds.

- Offline-first: Provide essential functionality without internet access.

In fintech, speed equals trust.

11. Best Practices for Fintech UX

- Simplicity: Remove clutter, focus on essentials.

- Security: Communicate protections clearly.

- Personalization: Adjust experiences to individual goals and preferences.

- Accessibility: Ensure inclusivity with WCAG standards and universal design.

12. Challenges in Fintech Design

- Regulations: Compliance with GDPR, PSD2, and local laws like KVKK.

- Trust: Building confidence in data handling and transactions.

- Performance: Avoiding downtime or delays that damage credibility.

- Accessibility: Designing for all users, regardless of ability.

Conclusion: UX = Financial Success

In fintech, design is no longer about aesthetics; it’s about strategy. A user-centered, secure, and personalized experience directly translates into higher retention, stronger loyalty, and real business value.

At VOYA, we specialize in crafting financial products where UX is the foundation of success. Because a great fintech application doesn’t just look good, it empowers users and strengthens the brand behind it.

Explore All Blogs

Ready to talk

about your project?

Do you have a clear vision regarding the ideas, goals, requirements, and desired outcomes for your project? Let's take the first step together by setting up a meeting to bring all of these to life.